Corbeil Limited, a private company following ASPE, disposed of some assets during the fiscal year ended December

Question:

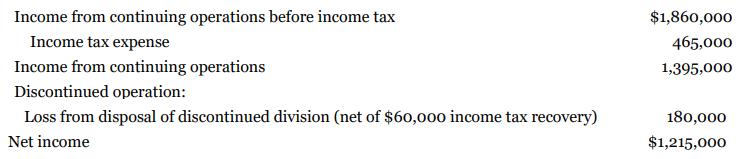

Corbeil Limited, a private company following ASPE, disposed of some assets during the fiscal year ended December 31, 2020. Based on the research done by the assistant controller, journal entries were made and the following first draft of the income statement was prepared. As controller, you have determined that the assets disposed of do not qualify for treatment as a discontinued operation.

Instrucations

a. Prepare the general journal entries, if any, that Corbeil should make at December 31, 2020.

b. What effect will this change have on the assets and liabilities reported on the SFP at December 31, 2020?

c. Prepare a revised draft of the partial income statement at December 31, 2020.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy