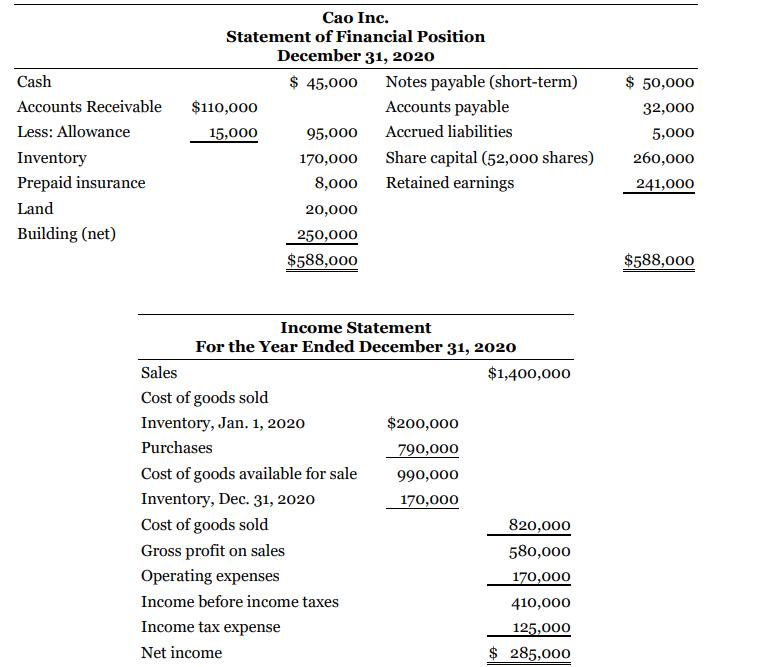

Financial information for Cao Inc. follows. Instructions a. Calculate the following ratios or relationships of Cao Inc.

Question:

Financial information for Cao Inc. follows.

Instructions

a. Calculate the following ratios or relationships of Cao Inc. Assume that the ending account balances are representative unless the information provided indicates differently.

1. Current ratio

2. Inventory turnover

3. Receivables turnover

4. Average age of receivables (days sales outstanding)

5. Average age of payables (days payables outstanding, based on cost of goods sold only)

6. Earnings per share

7. Profit margin on sales

8. Rate of return on assets

b. For each of the following transactions, indicate whether the transaction would improve, weaken, or have no effect on the current ratio of Cao Inc. at December 31, 2020.

1. Writing off an uncollectible account receivable for $2,200

2. Receiving a $20,000 down payment on services to be performed in 2020

3. Paying $40,000 on notes payable (short-term)

4. Collecting $23,000 on accounts receivable

5. Purchasing equipment on account

6. Giving an existing creditor a short-term note in settlement of an open account payable

7. Recording an impairment loss on land

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy