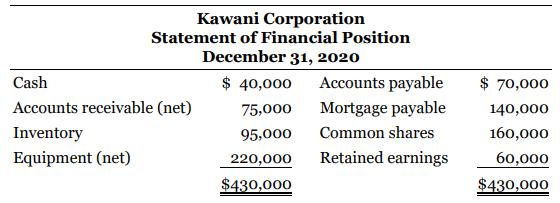

Kawani Corporation has been operating for several years. On December 31, 2020, it presented the following SFP.

Question:

Kawani Corporation has been operating for several years. On December 31, 2020, it presented the following SFP.

Cost of goods sold in 2020 was $420,000, operating expenses were $51,000, and net income was $27,000. Accounts payable suppliers provided operating goods and services. Assume that total assets are the same in 2019 and 2020.

Instructions

Calculate each of the following ratios:

a. Current ratio

b. Acid-test ratio

c. Debt to total assets ratio

d. Rate of return on assets

e. Days payables outstanding (include cost of goods sold and operating expenses)

For each ratio, also indicate how it is calculated and what its significance is as a tool for analyzing Kawani's financial position, profitability, and liquidity.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy