Pear Company (PC) had been renting its office building for several years. On January 1, 2016, it

Question:

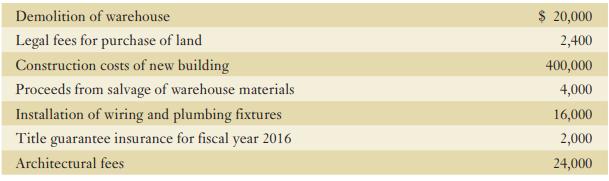

Pear Company (PC) had been renting its office building for several years. On January 1, 2016, it decided to have a new office building constructed. On that date, it acquired land with an abandoned warehouse on it for $100,000. Other costs included the following:

Required:

a. Indicate what balance PC should record in the following accounts for the acquisition:

(i) land account,

(ii) building account.

b. Assume that the building was completed on December 31, 2016, and was occupied on that date. It has an estimated useful life of 40 years, with a residual value of $50,000.

Calculate depreciation for 2017 using

(i) The straight-line method

(ii) The double-declining-balance method.

c. Assume that management decided to use straight-line depreciation for the building. By 2020 PC had grown considerably and needed to relocate to a larger space; it sold the land and building to Sparrow Company on July 1, 2020, for $680,000. Assume depreciation expense has already been recorded for the first six months of the year ( January 1 to June 30, 2020). Prepare all journal entries required relating to the land and building accounts on July 1, 2020.

Step by Step Answer: