Refer to the data in BE6.14 for Smart Information Technology Company. Prior to making the adjustment in

Question:

Refer to the data in BE6.14 for Smart Information Technology Company. Prior to making the adjustment in BE6.14 part (b), cost of goods sold for 2024 was $418,500. What is the correct ending inventory that should be reported on the balance sheet at December 31, 2024? What is the correct cost of goods sold that should be reported on the income statement for the year ended December 31, 2024?

Data from BE6.14

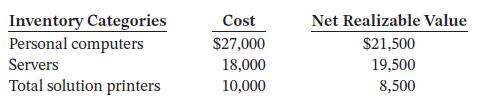

Smart Information Technology Company has the following cost and net realizable value data at December 31, 2024:

a. Calculate the lower of cost and net realizable value valuation assuming Smart Information Technology Company applies LCNRV to individual products.

b. What adjustment should the company record if it uses a perpetual inventory system?

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak