Rodriguez Corp. changed from the straight-line method of depreciation on its plant assets acquired in early 2018

Question:

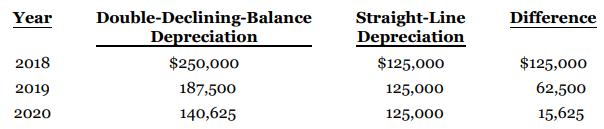

Rodriguez Corp. changed from the straight-line method of depreciation on its plant assets acquired in early 2018 to the double-declining-balance method in 2020 (before finalizing its 2020 financial statements) because of a change in the pattern of benefits received. The assets had an eight-year life and no expected residual value. Information related to both methods follows:

Net income for 2019 was reported at $270,000; income for 2020 before depreciation and income tax is $300,000. Assume an income tax rate of 30%.

Instructions

The change from the straight-line method to the double-declining-balance method is considered a change in estimate.

a. What net income is reported for 2020?

b. What is the amount of the adjustment to opening retained earnings as at January 1, 2020?

c. What is the amount of the adjustment to opening retained earnings as at January 1, 2019?

d. Prepare the journal entry(ies), if any, to record the adjustment in the accounting records, assuming that the accounting records for 2020 are not yet closed.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy