Sandhawalia Inc. (SI) sold a division of its business in 2020 for $2,700,000 cash and a $1,800,000,

Question:

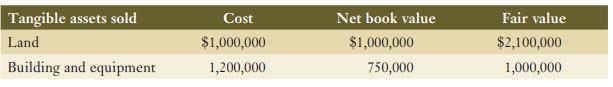

Sandhawalia Inc. (SI) sold a division of its business in 2020 for $2,700,000 cash and a $1,800,000, 4% note repayable in annual installments of $495,882. The interest rate charged approximated the market rate of interest for similar transactions. Other pertinent details follow:

When SI acquired the division in 2013, $310,000 of the purchase price was allocated to goodwill. In 2014, the value of the cash generating unit was found to be impaired and $85,000 of goodwill was written off.

SI was granted a copyright in 2015 for original material produced by the company. The immaterial costs of obtaining the copyright were expensed at the time. In 2017, SI spent $240,000 to successfully defend the copyright. At the time of the defence, the remaining expected useful life of the copyright was 12 years. SI records a full year of depreciation expense in the year of origination but none in the year of disposal. The estimated fair value of the copyright at the time of the sale was $850,000.

Required:

Prepare the journal entry to record the sale of the assets assuming that Sandhawalia Inc. uses the net method to record intangibles. Segregate the gain or loss on the sale into its component parts, for example, arising from the sale of the land.

Step by Step Answer: