Question: The following comparative data are available from the 20X4 statement of financial position of Trevor Holdings Ltd: In 20X4, the following transactions took place and

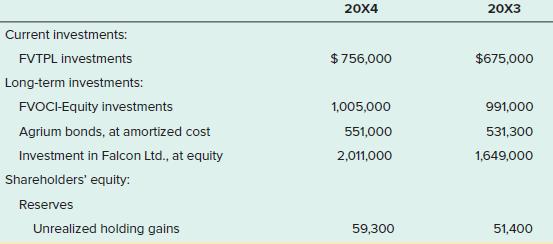

The following comparative data are available from the 20X4 statement of financial position of Trevor Holdings Ltd:

In 20X4, the following transactions took place and are properly reflected in the accounts, above.

a. There were no purchases or sales of FVTPL investments during the year.

b. Dividends of $80,000 were received from Falcon Ltd. No shares of Falcon were bought or sold during the year.

c. FVOCI Equity investments, with a carrying value of $42,800 and cumulative holding gains of $18,000 to date, were sold for $64,400. Holding gains and losses in reserves are not reclassified on sale.

d. FVOCI Equity investments were purchased during the year.

e. FVTPL and FVOCI Equity investments were adjusted to fair value at year end.

Required:

What items would appear on the 20X4 statement of cash flows? Assume the operating section uses the indirect method of presentation. Cash inflow from investment revenue is classified in operating activities.

20X4 20X3 Current investments: FVTPL investments $756,000 $675,000 Long-term investments: FVOCI-Equity investments 1,005,000 991,000 Agrium bonds, at amortized cost 551,000 531,300 Investment in Falcon Ltd., at equity 2,011,000 1,649,000 Shareholders' equity: Reserves Unrealized holding gains 59,300 51,400

Step by Step Solution

3.42 Rating (168 Votes )

There are 3 Steps involved in it

CFS disclosures Operating activities Less Discount amortization on longterm bond investme... View full answer

Get step-by-step solutions from verified subject matter experts