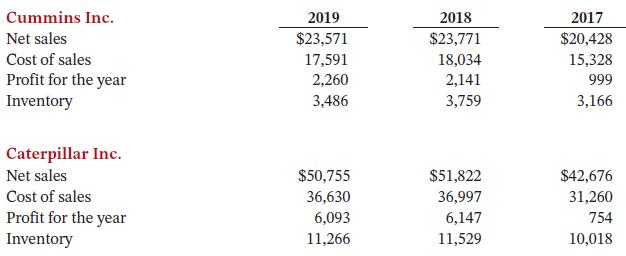

The following financial information (in US$ millions) is for two major corporations for the three fiscal years

Question:

The following financial information (in US$ millions) is for two major corporations for the three fiscal years ended December 31 as follows:

Instructions

a. Calculate the inventory turnover, days sales in inventory, and gross profit margin for each company for 2019 and 2018.

b. Comment on your findings.

Taking It Further

Cummins Inc. reports in the notes to the financial statements that approximately 14% of inventory is valued using the last-in, first-out (LIFO) cost method and the remaining inventory is valued using the first-in, first-out (FIFO) cost method. Caterpillar Inc. reports that its inventory is principally valued using the LIFO method. What impact does the use of LIFO have on a comparative analysis of the two companies?

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak