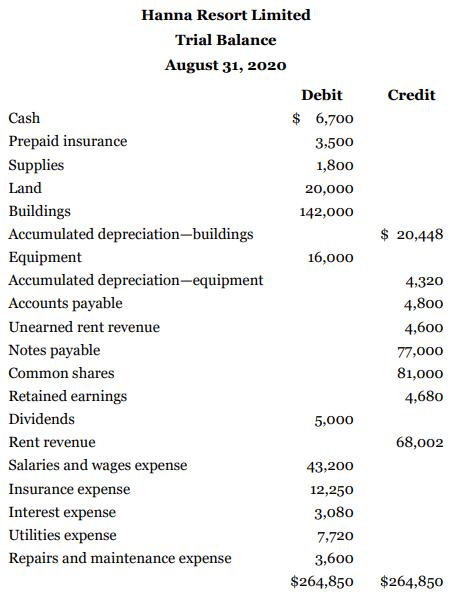

The trial balance for Hanna Resort Limited on August 31 is as follows: Additional information: 1. The

Question:

The trial balance for Hanna Resort Limited on August 31 is as follows:

Additional information:

1. The balance in Prepaid Insurance includes the cost of four months premiums for an insurance policy that will expire on September 30, 2020.

2. An inventory count on August 31 shows $650 of supplies on hand.

3. Buildings and equipment are depreciated straight-line. From the date of purchase, the buildings have an estimated useful life of 25 years, and the equipment has an estimated useful life of 10 years. For both asset categories, residual value is estimated to be 10% of cost.

4. (i) Rent revenue includes amounts received for September rentals in the amount of $8,000. (ii) Of the unadjusted Unearned Rent Revenue of $4,600, one half was earned prior to August 31.

5. Salaries of $375 were unpaid at August 31.

6. Rental fees of $800 were due from tenants at August 31. Use Accounts Receivable.

7. The note payable interest rate is 8% per year, and the note has been outstanding since December 1, 2019. No principal repayments are due. Interest is paid twice per year (on June 1 and December 1).

Instructions

a. Journalize the adjusting entries on August 31 for the three-month period from June 1 to August 31.

b. Prepare an adjusted trial balance as at August 31.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy