Colavecchia Ltd. had a taxable loss of $1,500,000 in 20X8. The tax rate in 20X8 is 28%.

Question:

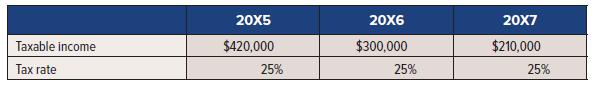

Colavecchia Ltd. had a taxable loss of $1,500,000 in 20X8. The tax rate in 20X8 is 28%. In the past three years, the company had the following taxable income and tax rates:

There are no temporary differences other than those created by income tax losses. The loss was triggered by a downturn in the economy.

Required:

1. What is the amount of refund that will be claimed in 20X8?

2. What is the amount of the loss carryforward?

3. Assuming that loss carryforward usage is probable, prepare a journal entry for income tax in 20X8.

4. Assuming that loss carryforward usage is not probable, prepare a journal entry for income tax in 20X8.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel