DCM Metals Ltd. has a 31 December year-end. The tax rate is 30% in 20X4, 35% in

Question:

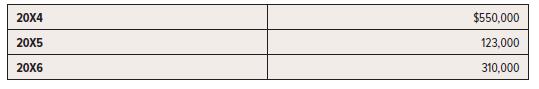

DCM Metals Ltd. has a 31 December year-end. The tax rate is 30% in 20X4, 35% in 20X5, and 42% in 20X6. The company reports earnings as follows:

Taxable income and accounting income are identical except for a $300,000 revenue reported for accounting purposes in 20X4, with one-half reported in 20X5 and one-half in 20X6 for tax purposes. The revenue is related to a long-term account receivable, taxable only when collected.

Required:

Compute tax expense and deferred income tax on the statement of financial position for 20X4, 20X5, and 20X6.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel

Question Posted: