EC Construction Ltd. (EC) has 100,000 common shares outstanding in public hands. The balance of retained earnings

Question:

EC Construction Ltd. (EC) has 100,000 common shares outstanding in public hands. The balance of retained earnings at the beginning of 20X7 was $2,400,000. On 15 December 20X7 EC declared dividends of $3 per share payable on 5 January 20X8. Income before income tax was $600,000 based on the records of the company’s accountant.

Additional information on selected transactions/events is provided below:

a. At the beginning of 20X6, EC purchased some equipment for $230,000 (salvage value of $30,000) that had a useful life of five years. The accountant used a 40% declining-balance method of depreciation but mistakenly deducted the salvage value in calculating depreciation expense in 20X6 and 20X7.

b. As a result of an income tax audit of 20X5 taxable income, $74,000 of expenses claimed as deductible expenses for tax purposes was disallowed by the CRA. This error cost the company $29,600 in additional tax. This amount was paid in 20X7 but has been debited to a prepaid expense account.

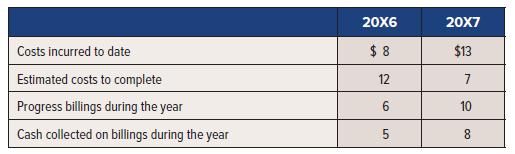

c. EC contracted to build an office building for RD Corp. The construction began in 20X6 and will be completed in 20X8. The contract has a price of $30 million. The following data (in millions of dollars) relate to the construction period to date:

The accountant used the completed-contract method in accounting for this contract, which is not permitted for a public company.

d. On 1 January 20X7, EC purchased, as a long-term investment, 19% of the common shares of One Ltd. for $50,000. On that date, the fair value of identifiable assets of One was $220,000 and was equal to the book value of identifiable assets. Goodwill has not been impaired. No investment income has been recorded. One paid no dividends, but reported income of $25,000 in the year. EC has significant influence over One.

e. EC has an effective tax rate of 40%.

Required:

1. Calculate 20X7 earnings for EC.

2. Prepare the retained earnings section of the comparative statement of changes in equity.

Comparative numbers need not be shown.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel