Fellows Inc. started operations on 1 January 20X8 and purchased $2,000,000 of equipment. The income tax rate

Question:

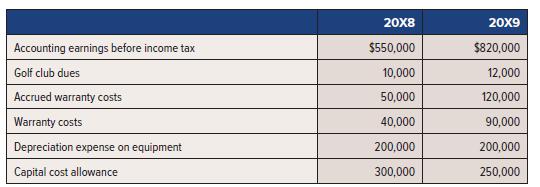

Fellows Inc. started operations on 1 January 20X8 and purchased $2,000,000 of equipment. The income tax rate was 40% in 20X8 and 38% in 20X9. The following is information related to 20X8 and 20X9:

Required:

1. Prepare all income tax journal entries for 20X8 and 20X9.

2. What are the deferred tax balances on the statement of financial position in 20X8 and 20X9?

Accounting earnings before income tax Golf club dues Accrued warranty costs Warranty costs Depreciation expense on equipment Capital cost allowance 20X8 $550,000 10,000 50,000 40,000 200,000 300,000 20X9 $820,000 12,000 120,000 90,000 200,000 250,000

Step by Step Answer:

Requirement 1 Requirement 2 Tax calculations Accounting earnings before income tax Add permanen...View the full answer

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

On January 1, Year 1, Green Inc. purchased 100% of the common shares of Mansford Corp. for $335,000. Greens balance sheet data on this date just prior to this acquisition were as follows: The balance...

-

The following are several transactions of Ardery Company that occurred during the current year and were recorded in permanent (that is, balance sheet) accounts unless indicated otherwise: Date...

-

ALMA.com is an e-commerce service for teenagers' video games, television programs, and other material, intended to be both educational and enjoyable. Valuable product information and detailed review...

-

Misty Cumbie worked as a waitress at the Vita Caf in Portland, Oregon. The caf was owned and operated by Woody Woo, Inc. Woody Woo paid its servers an hourly wage that was higher than the states...

-

Refer to Data Set 10 in Appendix B and use the amounts of nicotine (mg per cigarette) in the king-size cigarettes, the 100-mm menthol cigarettes, and the 100-mm nonmenthol cigarettes. The king-size...

-

Give examples about companies who focused on operational effectiveness rather than strategy.

-

Determine whether the events are independent or dependent. 1. Selecting a king (A) from a standard deck of 52 playing cards, not replacing it, and then selecting a queen (B) from the deck 2. Tossing...

-

1. Which of the sales force structures discussed in the text best describes P&Gs CBD structure? 2. From the perspective of team selling, discuss the positive as well as some possible negative aspects...

-

1 - Which activity did you select (case study or training) and why? 2 - What were two (2) pieces of information stood out to you in this activity? 3 - What do diversity, equity, and inclusion mean...

-

The records of Samuel Corp. provided the following data at the end of years 1 through 4 relating to income tax allocation: The above amounts include only one temporary difference; no other changes...

-

Renat Mehali is a junior accountant, working in the same group as you at your public accounting firm, P&A Partners. Renat looks up to you and often turns to you for guidance and mentorship. Renat is...

-

With $10,000 available, you have two investment options. The first option is to buy a certificate of deposit from a bank at an interest rate of 10% annually for five years. The second choice is to...

-

3) How did online banking technology change the cost structure of banks in terms of variable and fixed costs? How did this affect the structure of the banking industry? 4) Suppose that a market is...

-

Why would the probability of an employer offering retiree health insurance increase with the number of employees for large firms over 300 workers. Support your answer with scholarly resources.

-

What laws can be put in place to help protect consumers as well as make them have more trust in the law process? What is an instance where you have seen the law fall short when it comes to...

-

Justin is an unlucky soul who got Herpes Simplex Virus 1 (HSV-1) from his girlfriend in junior high. Now he is a carrier for HSV-1 and anytime he experiences high levels of stress, he develops cold...

-

Harrison Company reported the following cost information: November December Variable costs $ 1 8 , 0 0 0 ? Fixed costs $ 2 4 , 0 0 0 ? Mixed costs $ 3 0 , 0 0 0 ? Total costs $ 7 2 , 0 0 0 $ 8 9 , 0...

-

Why is "out-of-sample" data important for testing inductive models?

-

How has the globalization of firms affected the diversity of their employees? Why has increased diversity put an additional burden on accounting systems?

-

Financial reporting distinguishes equity into two broad components: contributed capital and accumulated income; the latter is further separated into retained earnings and accumulated other...

-

Which of the following transactions have the potential to directly affect the retained earnings portion of equity? Exclude indirect effects such as the transfer of income into retained earnings at...

-

For accounting purposes, of the following characteristics, which distinguish a common share from a preferred share? Explain your answer briefly. The share has no par value. The share has voting...

-

How do leaders in various fields implement strategies for delegating responsibilities and empowering team members to enhance collective time management capabilities within organizations ?

-

The scale factor for two similar circles is 1:4. The sum of their areas is 153 cm. Determine the area of each circle.

-

How does the implementation of intricate time management methodologies facilitate the cultivation of a proactive mindset, thereby catalyzing heightened efficiency and goal attainment ?

Study smarter with the SolutionInn App