Question: Gazra Inc. established a defined contribution pension plan at the beginning of 20X5. The company will contribute a specified percentage of each employees annual salary.

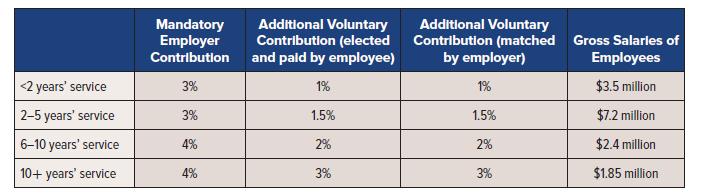

Gazra Inc. established a defined contribution pension plan at the beginning of 20X5. The company will contribute a specified percentage of each employee’s annual salary. These payments vest immediately, but the percentage contributed depends on the number of years that the employees have been with the organization. In addition, employees can elect to contribute additional funds as a direct deduction from their pay. For the employees that make this election, the contribution is matched by Gazra. The following chart outlines the additional contribution structure:

The following is the percentage of total salaries with employees that elected into the voluntary contribution plan:

• • 2–5 years’ service—60% of gross salaries

• 6–10 years’ service—65% of gross salaries

• 10+ years—85% of gross salaries

Required:

Calculate the following for each class of employee for 20X5:

1. Mandatory defined contribution pension expense

2. Voluntary defined contribution pension expense

3. Total pension contribution (Note: This is not the pension expense.)

Step by Step Solution

3.42 Rating (165 Votes )

There are 3 Steps involved in it

1 Mandatory pension expense mandatory employer contribution x salaries of employe... View full answer

Get step-by-step solutions from verified subject matter experts