Globile Corporate is a public corporation listed on the Toronto Stock Exchange. The company has three classes

Question:

Globile Corporate is a public corporation listed on the Toronto Stock Exchange. The company has three classes of shares, as follows:

• Common shares (no par-value, unlimited authorized)

• Series A preferred shares (no par value, $0.75 cumulative, nonparticipating)

• Series B preferred shares (no par value, $0.50 non-cumulative, participating with common shareholders after the common shareholders receive $0.25 per share; participation is based on relative number of shares outstanding).

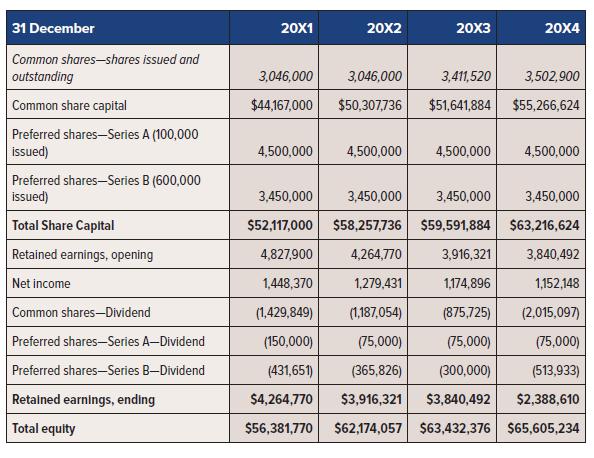

The following is a partial statement of changes in equity for Globile from 20X1 to 20X4 is as follows:

A friend of yours is a common shareholder of Globile and has approached you with the following concern:

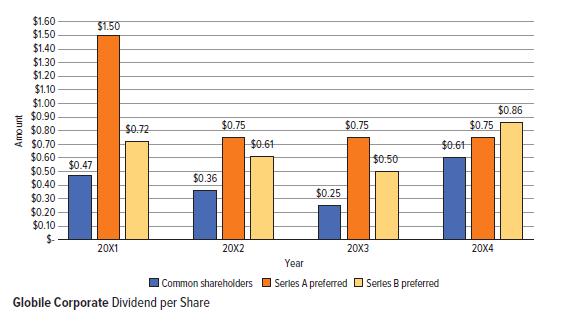

I have just reviewed the most recent financial statements of Globile. I do not understand why the dividend per share has been so volatile. Another thing that is confusing to me:

Total dividends paid have gone up, but I would have expected to see a more significant increase in my per-share amount. How does that make sense when the preferred shares have a fixed amount per share?

Required:

Interpret the information presented, and prepare an explanation for your friend.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel