Golden Ltd. had the following transactions in 20X5: a. Bought goods on 1 June from Brit Ltd.

Question:

Golden Ltd. had the following transactions in 20X5:

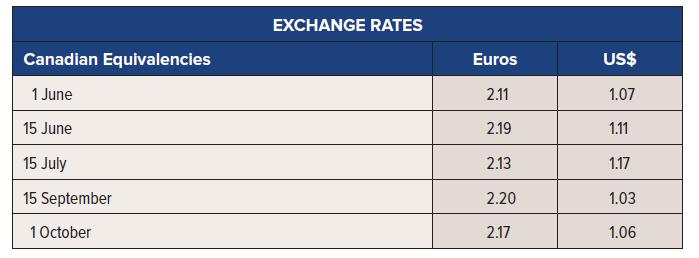

a. Bought goods on 1 June from Brit Ltd. for 70,000 euros, with payment due in four months’ time.

b. Bought goods from New York Sales Corp. on 15 June for US$150,000; payment was due in one month.

c. Bought goods from London Ltd. on 15 July for 20,000 euros; settlement was to be in two months.

d. Paid New York Sales Corp. on 15 July.

e. Paid London Ltd. on 15 September.

f. Paid Brit Ltd. on 1 October.

Required:

Prepare journal entries for the above transactions.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel

Question Posted: