Question: Golf Inc., which began operations in 20X3, uses the same policies for financial accounting and tax purposes with the exception of warranty costs and franchise

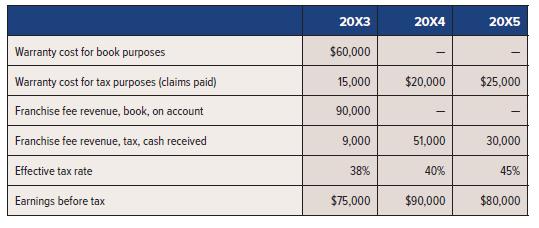

Golf Inc., which began operations in 20X3, uses the same policies for financial accounting and tax purposes with the exception of warranty costs and franchise fee revenue. Information about the $60,000 of warranty expenses and $90,000 franchise revenue accrued for book purposes is provided below:

Required:

Prepare journal entries to record taxes for 20X3 to 20X5. The tax rate for a given year is not enacted until that specific year.

Warranty cost for book purposes Warranty cost for tax purposes (claims paid) Franchise fee revenue, book, on account Franchise fee revenue, tax, cash received Effective tax rate Earnings before tax 20X3 $60,000 15,000 90,000 9,000 38% $75,000 20X4 $20,000 51,000 40% $90,000 20X5 $25,000 30,000 45% $80,000

Step by Step Solution

3.31 Rating (157 Votes )

There are 3 Steps involved in it

Earnings before tax Timing differences Warranty expense tax deduction Franchise accounting fee reven... View full answer

Get step-by-step solutions from verified subject matter experts