Griffiths Ltd. has a five-year lease, and the following lease liability amortization table was prepared when the

Question:

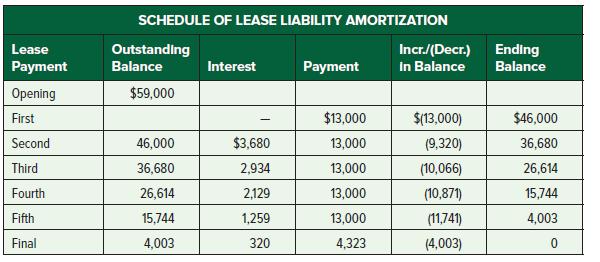

Griffiths Ltd. has a five-year lease, and the following lease liability amortization table was prepared when the lease was originally signed, using an 8% interest rate. Griffiths expects to pay $4,323 at the end of the lease related to the residual value guarantee.

Required:

1. The lease was entered into on 1 March 20X5. Give the journal entries for 20X5, up to and including the 31 December 20X5 adjusting journal entries for the end of the fiscal year.

The company uses the half-year rule for depreciation.

2. It is now 31 December 20X7. All payments have been made on schedule, and all entries have been made correctly. Calculate 20X7 total interest expense, and the amount that will appear on the 31 December 20X7 SFP with respect to the lease liability. Show the current and long-term amounts separately.

3. At the end of the fifth lease year, Griffiths must pay $1,623 in cash related to the residual value guarantee. Provide all journal entries that would be made on this date with respect to interest, depreciation, the sale and final payment to the lessor.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel