PhonUs Ltd. (PUL) is a Canadian public company involved in network technology for mobility telecommunications. This network

Question:

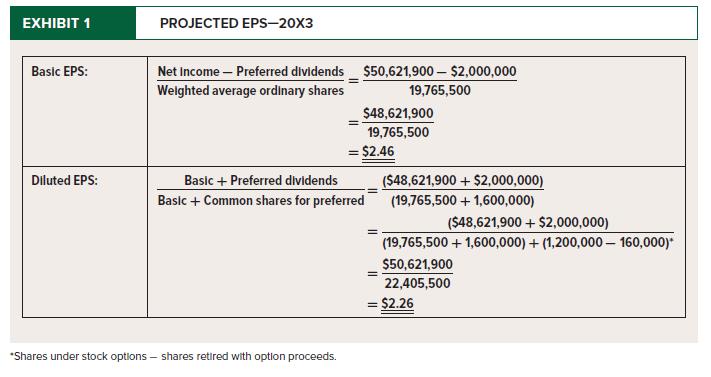

PhonUs Ltd. (PUL) is a Canadian public company involved in network technology for mobility telecommunications. This network technology allows super-fast data services to be offered through mobile platforms at a premium rate as a strategy to increase revenue per user for the carriers. PUL’s customers are mobility carriers in many North, Central, and South American countries. In 20X2, PUL reported basic earnings per share of $2.27 and diluted EPS of $2.10. The company forecasted EPS growth of approximately 12% for 20X3.

Unfortunately, 20X3 revenues were relatively flat through the first three quarters. PUL reported an EPS growth rate of 8% during the first three quarters, an increase that had been generated largely through cost reduction rather than revenue growth. Internal projections indicated that this lower growth rate in EPS would likely be reported for the overall year if immediate action was not taken. Exhibit 1 shows the projected annual 20X3 EPS figures, reflecting the 8% improvement from operations.

Consequently, early in the fourth quarter, senior management began to discuss ways to “close the gap” between the 8% actual EPS growth rate and the 12% target. Mindful of the sluggish stock market share price, and with an eye on its own compensation and stock option packages, management expressed strong interest in making significant changes before the end of the 20X3 fiscal year.

PUL has 1.2 million common shares promised for future distribution under option contracts granted to senior management. Stock options are a substantial element of compensation. Additional options will be granted at the end of 20X3. The options granted will be at a price equal to the current share price and will vest immediately. They may be exercised in four years’ time, as long as the manager is still with PUL. The number of shares granted under option depends on corporate performance and could range from zero to 500,000 shares.

A number of situations and/or opportunities that would potentially affect EPS for the year have been discussed internally. For example, management has proposed that 850,000 common shares be repurchased and retired in the fourth quarter. The required funding for this, $16,150,000, would have to be borrowed. Management is permitted to borrow up to $2 billion without further board of directors’ approval; at the end of the third quarter, outstanding debt amounted to $1.8 billion. This buyback would be completed by 1 November. The interest rate on this new debt is estimated to be 6%.

PUL has idle land on the books at an historical cost of $695,000 that was purchased early in 20X3. The company is holding this land for capital appreciation and therefore is considering changing its accounting policy for this land to account for it using the fair-value method. The market value of this land is $1,180,000.

The company has an investment in bonds that is currently being held with the objective to receive the interest and principal payments and is classified as amortized cost. The current amortized cost of the bonds is $480,000 with an effective interest rate of 5%. The company has decided to reclassify this bond as FVOCI-Bonds. The fair market value of the bonds is estimated to be $530,000 by 31 December.

PUL has a major order for product that is complete, but the customer does not want it delivered until the first quarter of 20X4. The product is complete and the company has put it aside in its warehouse, separate from its other inventory that is available for sale. Because the product is complete and simply waiting for the customer to tell PUL when it can be shipped, PUL believes that it can be booked as revenue in the last quarter. The amount of revenue related to this sale is $2,500,000 and the related cost of goods sold is $1,950,000.

During October, the PUL board of directors of is expected to approve that the division operating in India, Bombay Telecom Limited (BTL), will be put up for sale. Operations are planned to cease on 15 November, and net losses with respect to this division are estimated to be $425,000 (before-tax) (currently included in the estimated net income). Since the company already has a few interested buyers, it expects that the division will be sold in the first quarter in 20X4. Based on preliminary estimates, the company expects a gain on disposal (after-tax) to be $320,000.

Required:

Prepare a report for management in which you explain the effects that the situations described above would have on basic earnings per share for the 20X3 fiscal year. Assume that PUL has a 25% marginal income tax rate. Also, point out any concerns that management should consider before undertaking these proposed solutions to the EPS situation.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel