Question: Refer again to the data in A17-6. Data From A17-6 Tyler Toys Ltd. reported the following: Required: 1. Provide the journal entry to record the

Refer again to the data in A17-6.

Data From A17-6

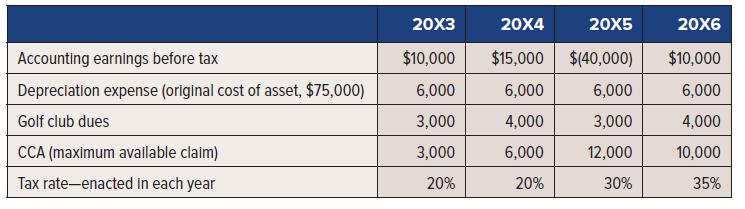

Tyler Toys Ltd. reported the following:

Required:

1. Provide the journal entry to record the benefit of the tax loss in 20X5, assuming that the tax loss is first used as a tax loss carryback and the remainder is available as a tax loss carryforward. Be sure to adjust the deferred income tax account for the temporary difference between depreciation and CCA and also the change in tax rates.

2. What condition has to be met to record the loss in 20X5?

Accounting earnings before tax Depreciation expense (original cost of asset, $75,000) Golf club dues CCA (maximum available claim) Tax rate-enacted in each year 20X3 $10,000 6,000 3,000 3,000 20% 20X4 20X5 20X6 $15,000 $(40,000) $10,000 6,000 6,000 6,000 4,000 3,000 4,000 6,000 12,000 10,000 20% 30% 35%

Step by Step Solution

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Requirement 1 Requirement 2 In order to record the benefit of the ... View full answer

Get step-by-step solutions from verified subject matter experts