Question: Return to the facts of Assignment 13-10. Data From Assignment 13-10 The following partial amortization table was developed for a 5.4%, $800,000 5-year bond that

Return to the facts of Assignment 13-10.

Data From Assignment 13-10

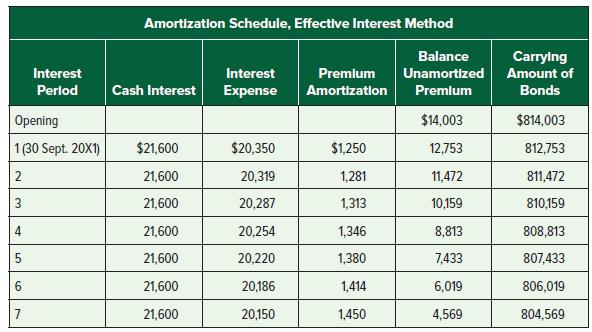

The following partial amortization table was developed for a 5.4%, $800,000 5-year bond that pays interest each 30 September and 31 March. The table uses an effective interest rate of 5%. The bond was dated 1 April 20X1.

Required:

1. Prepare a bond amortization table, as provided in A13-9, using the straight-line method, permitted under ASPE standards. Include only seven payments in the table.

2. Assume that the bond was issued on 1 April 20X1. Prepare all entries for 20X1 and 20X2. The fiscal year ends on 31 December.

3. Show how the bond would be reported on the statement of financial position as of 31 December 20X2, consistent with the entries in requirement 2.

4. Calculate, for period 1 and 7, interest expense as a percentage of the opening bond liability. Explain why this is not the yield rate of 5%.

Interest Period Opening 1 (30 Sept. 20X1) 2 3 4 5 6 7 Amortization Schedule, Effective Interest Method Balance Unamortized Premium Cash Interest $21,600 21,600 21,600 21,600 21,600 21,600 21,600 Interest Expense $20,350 20,319 20,287 20,254 20,220 20,186 20,150 Premium Amortization $1,250 1,281 1,313 1,346 1,380 1,414 1,450 $14,003 12,753 11,472 10,159 8,813 7,433 6,019 4,569 Carrying Amount of Bonds $814,003 812,753 811,472 810,159 808,813 807,433 806,019 804,569

Step by Step Solution

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Requirement 1 Requirement 2 Requirement 3 Requirement 4 In the first period interest expe... View full answer

Get step-by-step solutions from verified subject matter experts