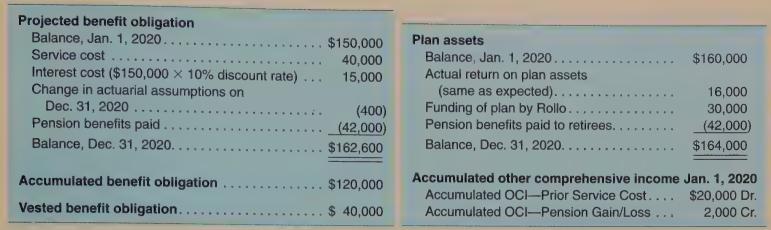

Question: Rollo Company has a defined benefit pension plan. At the end of the current reporting period, December 31, 2020 , the following information was available:

Rollo Company has a defined benefit pension plan. At the end of the current reporting period, December 31, 2020 , the following information was available:

Required

a. Create a worksheet to summarize the pension data at the end of 2020. Assume that Rollo uses the corridor approach in amortizing the pension gain/loss. Assume an average remaining service period of 10 years.

b. Provide Rollo's pension entries at December 31, 2020.

Projected benefit obligation Balance, Jan. 1, 2020... $150,000 Service cost 40,000 Interest cost ($150,000 x 10% discount rate) 15,000 Change in actuarial assumptions on Plan assets Balance, Jan. 1, 2020.. Actual return on plan assets (same as expected).. $160,000 16,000 Dec. 31, 2020. (400) Funding of plan by Rollo.. Pension benefits paid. (42,000) Pension benefits paid to retirees... Balance, Dec. 31, 2020.. Accumulated benefit obligation $162,600 Balance, Dec. 31, 2020.... 30,000 (42,000) $164,000 $120,000 Vested benefit obligation.... $ 40,000 Accumulated other comprehensive income Jan. 1, 2020 Accumulated OCI-Prior Service Cost.... $20,000 Dr. Accumulated OCI-Pension Gain/Loss 2,000 Cr.

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts