Seeko Inc. is a public company that reports EPS figures. It has a 31 December year-end date.

Question:

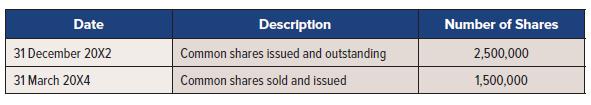

Seeko Inc. is a public company that reports EPS figures. It has a 31 December year-end date. It issued its 20X4 year-end financial statements on 20 February 20X5. The following information relates to Seeko Inc.’s capital structure:

Shares were issued as a result of a 10% stock dividend on 30 September 20X3. On 31 March 20X5 a stock split occurred at a rate of 3-for-1.

Required:

1. What is the weighted average number of common shares that should be used in calculating basic EPS for 20X3?

2. When preparing the 20X4 financial statements, what is the weighted average number of common shares that should be used in calculating EPS for 20X3?

3. Reflect on your answer for requirement 2 and explain why this treatment is appropriate.

4. What is the weighted average number of common shares that should be used in calculating basic EPS for 20X4?

5. If the stock split on 31 March 20X5 had instead been a stock dividend, how would this be handled for the purpose of calculating WAOS?

6. Based on the information provided about Seeko Inc., does the company need to report diluted EPS for any of 20X3, 20X4, or 20X5?

7. Does your answer to requirement 6 change if Seeko Inc. has discontinued operations in 20X3?

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel