Question: Selected data is provided below for KLS Co.: Required: Calculate the cash conversion cycle for 20X5 and 20X4. Is it likely that the company has

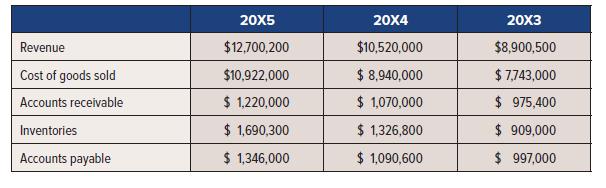

Selected data is provided below for KLS Co.:

Required:

Calculate the cash conversion cycle for 20X5 and 20X4. Is it likely that the company has shortterm investments or requires short-term bank financing?

Revenue Cost of goods sold Accounts receivable Inventories Accounts payable 20X5 $12,700,200 $10,922,000 $ 1,220,000 $ 1,690,300 $ 1,346,000 20X4 $10,520,000 $ 8,940,000 $ 1,070,000 $ 1,326,800 $ 1,090,600 20X3 $8,900,500 $7,743,000 $ 975,400 $ 909,000 $ 997,000

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Selected data is provided below for KLS Co The cash cycle has increased ... View full answer

Get step-by-step solutions from verified subject matter experts