Senior Home Living (SHL) is a Canadian-based corporation located in British Columbia. SHL provides senior living residences

Question:

Senior Home Living (SHL) is a Canadian-based corporation located in British Columbia. SHL provides senior living residences across Canada. The company was incorporated in 1975, and has been successful ever since. The company has enjoyed considerable growth due to the insight of its management team and the exceptional level of care provided by its employees. It is 2 February 20X9, and you, as a professional accountant with the accounting firm Shetty & Thomas, have been asked by SHL’s president, Subramanian Kaadi, to fill in as acting controller at SHL. The current controller, Janelle Chu, has gone on an extended personal leave. The assistant controller, Nicholas Diamond, has been assisting with the transition. Nicholas is not a professional accountant, but he is very energetic and willing to work extra hours when needed. Nicholas feels hat the head office staff’s bonus based on pre-tax income is a nice perk and he wants to make sure he is doing his best to help out his co-workers.

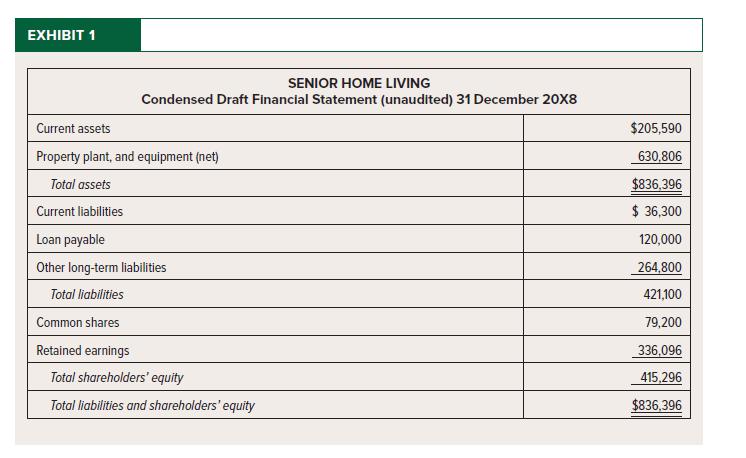

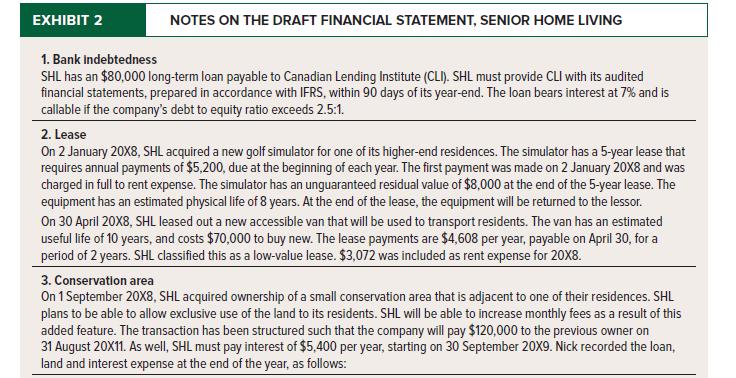

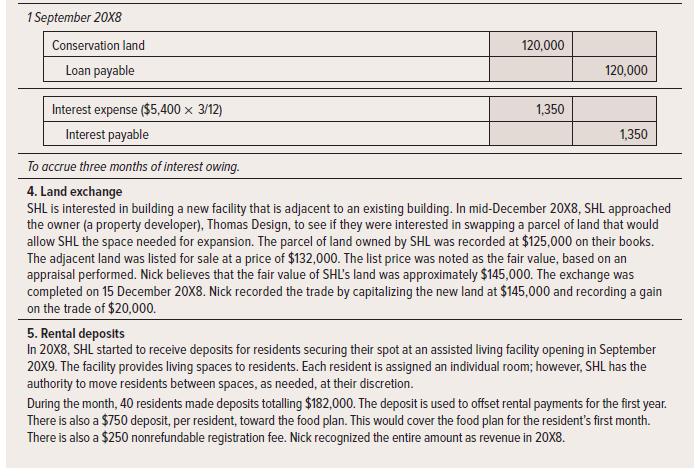

Mr. Kaadi wants you to review the draft condensed statement of financial position for 31 December 20X8 (Exhibit 1) prepared in accordance with IFRS. You also have reviewed the accounting for certain transactions underlying the draft statement (Exhibit 2). If you feel that any adjustments are needed, you are to explain the reason(s) and draft any necessary adjusting journal entries. You should then prepare a revised statement of financial position.

Required:

Prepare the information requested by Mr. Kaadi. SHL’s combined federal and provincial tax rate is 20%.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel