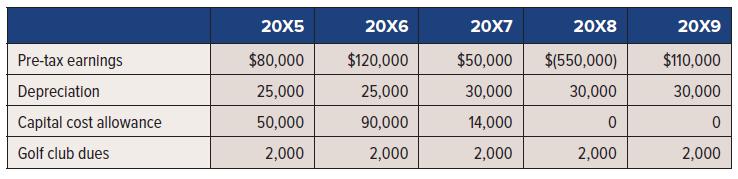

Simeoni Ltd. began operations in 20X5 and reported the following information for the years 20X5 to 20X9:

Question:

Simeoni Ltd. began operations in 20X5 and reported the following information for the years 20X5 to 20X9:

The income tax rate is 40% in all years. Assume that Simeoni’s only depreciable assets were purchased in 20X5 and cost $500,000.

Required:

1. Prepare the journal entries for income taxes for 20X8 and 20X9. In 20X8, it was determined by management that it was probable that the loss carryforwards would be realized.

2. What is the balance of deferred income tax at the end of 20X9? Show calculations.

3. Repeat requirements 1 and 2 with the assumption that management determined the tax loss carryforward would not be realized in 20X8. In addition, management decided to refile 20X5, 20X6, and 20X7 tax returns to eliminate CCA and use more of the loss as a loss carryback. The deferred tax asset caused by temporary differences can be recognized in 20X8. The probability of loss carryforward use did not change in 20X9, even though some of the loss carryforward was used.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel