SmartCo. has the following selected information for 20X6 and 20X7: The company pays taxes at the rate

Question:

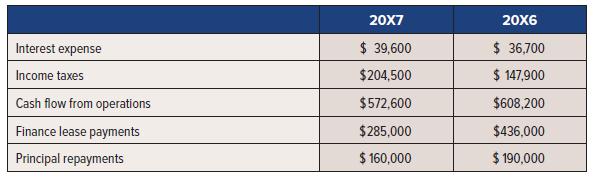

SmartCo. has the following selected information for 20X6 and 20X7:

The company pays taxes at the rate of 28%.

Required:

Calculate the times-debt-service-earned ratio for 20X6 and 20X7. Comment on what the ratio means and the trend from 20X6 to 20X7.

Transcribed Image Text:

Interest expense Income taxes Cash flow from operations Finance lease payments Principal repayments 20X7 $ 39,600 $204,500 $572,600 $285,000 $ 160,000 20X6 $36,700 $ 147,900 $608,200 $436,000 $ 190,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (8 reviews)

Times debt service earned 20X7 572600 39600 204500 39600285000 16000012...View the full answer

Answered By

Qurat Ul Ain

Successful writing is about matching great style with top content. As an experienced freelance writer specialising in article writing and ghostwriting, I can provide you with that perfect combination, adapted to suit your needs.

I have written articles on subjects including history, management, and finance. Much of my work is ghost-writing, so I am used to adapting to someone else's preferred style and tone. I have post-graduate qualifications in history, teaching, and social science, as well as a management diploma, and so am well equipped to research and write in these areas.

4.80+

265+ Reviews

421+ Question Solved

Related Book For

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel

Question Posted:

Students also viewed these Business questions

-

The Surf and Sand Inn's condensed income statement for 20X6 and 20X7 is as follows: Room Revenue Room department expenses Undistributed operating expenses Gross operating profit Insurance, property...

-

The following selected information was taken from the financial statements of one of the world's largest convenience store operators, Montreal-based Alimentation Couche-Tard Inc. (in U.S. $...

-

The following selected information was taken from Sun Valley Citys general fund statement of revenues, expenditures, and changes in fund balance for the year ended December 31, 2019: Revenues:...

-

If there is a decrease in the demand for Canadian dollars relative to U.S. dollars, a. The price and quantity of Canadian dollars traded will fall. b. The price and quantity of Canadian dollars will...

-

Which of the indicators in Fig. could be used for doing the titrations in Exercises 65 and 67? Fig Pheadl Red

-

Explain what factors the cost accountant should consider in choosing an allocation basis. LO1

-

A garden store prepares various grades of pine bark for mulch: nuggets (x1), mini-nuggets (x2), and chips (x3). The process requires pine bark, machine time, labor time, and storage space. The...

-

The following are financial statements for Germaine Company: The following information is also available for 2011: (a) Plant assets were sold for their book value of $180 during the year. The assets...

-

Fritz Corporation is an all-equity firm with an annual EBIT of $2,540,000 and a WACC of 15%. The current tax rate is 25%. Fritz Corp will have the same EBIT forever. If the company sells debt worth...

-

Four-year comparative statements of comprehensive income and SFP for Firenza Products Inc. (FPI) are shown below. FPI has been undergoing an extensive restructuring in which the company has...

-

Selected accounts from the SFP of ARM Co. at 31 August 20X3 and 20X2: Required: Calculate the debt to equity ratio for ARM. What has happened to the leverage of the company, and why? (in thousands of...

-

A car is originally worth $34,450. It takes 13 years for this car to totally depreciate. a. Write the straight line depreciation equation for this situation. b. How long will it take for the car to...

-

The following data apply to Superior Auto Supply Inc. for May 2011. 1. Balance per the bank on May \(31, \$ 8,000\). 2. Deposits in transit not recorded by the bank, \(\$ 975\). 3. Bank error; check...

-

How do you determine whether there is a linear correlation between two variables \(x\) and \(y\) ? Use Table 14.10. Table 14. 10 n a = 0.05 0.950 0.878 4 5 6 0.811 7 0.754 8 0.707 9 0.666 10 0.632 11...

-

Comparative Analysis Problem: Columbia Sportswear Company vs. Under Armour, Inc. The financial statements for the Columbia Sportswear Company can be found in Appendix A and Under Armour, Inc.'s...

-

The following information is available for Book Barn Company's sales on account and accounts receivable: After several collection attempts, Book Barn wrote off \(\$ 4,500\) of accounts that could not...

-

The following information comes from the accounts of Jersey Company: Required a. There were \(\$ 170,000\) of sales on account during the accounting period. Write-offs of uncollectible accounts were...

-

The truck has a mass of 4 Mg and mass center at G 1 , and the trailer has a mass of 1 Mg and mass center at G 2 , Determine the absolute maximum live moment developed in the bridge. G2 l1,5 ml1.5 ml...

-

What is master production scheduling and how is it done?

-

Anchovy Corp. issued a $1-million, four-year, 7.5% fixed-rate interest only, non-prepayable bond on December 31, 2019. Anchovy later decided to hedge the interest rate and change from a fixed rate to...

-

Spencer Ltd. established a SARs program on January 1, 2020, which entitles executives to receive cash at the date of exercise (any time in the next three years) for the difference between the shares'...

-

Barrett Limited established a share appreciation rights (SARs) program that entitled its new president, Angela Murfitt, to receive cash for the difference between the Barrett Limited common shares'...

-

4) Read the following case carefully and answer the given questions. You have been the finance director of a clothing retailer for ten years. The companys year end is 31st December 2019, and you are...

-

all of the other problems here on chegg don't describe right on how they god the answer. can you make it step by step math to show how you got what and from where and each number to get the answer...

-

D Required information The following Information applies to the questions displayed below.) Diego Company manufactures one product that is sold for $76 per unit in two geographic regions-the East and...

Study smarter with the SolutionInn App