Question: Smith Minerals Ltd. had compensation plans in effect for senior managers that included two longterm compensation elements. SFP accounts at the end of 20X6 are:

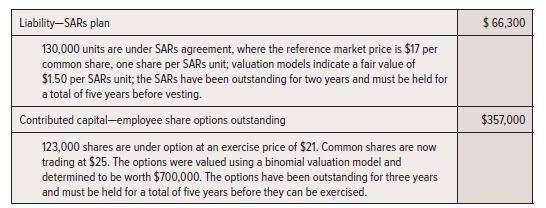

Smith Minerals Ltd. had compensation plans in effect for senior managers that included two longterm compensation elements. SFP accounts at the end of 20X6 are:

Retention levels were estimated to be 85% at the end of 20X6.

Required:

1. Describe the two kinds of compensation plans above. Provide the calculation to support the balances recorded.

2. Assume no new compensation entitlements were offered in 20X7. At year-end, the common share price was $33 and the fair value of a SARs unit was estimated to be worth $1.70. Retention is now assumed to be 80%. Give the entries to record compensation expense related to the above plans.

Liability-SARs plan 130,000 units are under SARS agreement, where the reference market price is $17 per common share, one share per SARS unit; valuation models indicate a fair value of $1.50 per SARS unit; the SARS have been outstanding for two years and must be held for a total of five years before vesting. Contributed capital-employee share options outstanding 123,000 shares are under option at an exercise price of $21. Common shares are now trading at $25. The options were valued using a binomial valuation model and determined to be worth $700,000. The options have been outstanding for three years and must be held for a total of five years before they can be exercised. $ 66,300 $357,000

Step by Step Solution

3.48 Rating (174 Votes )

There are 3 Steps involved in it

Requirement 1 The SARs program is payable in cash given that a liability is r... View full answer

Get step-by-step solutions from verified subject matter experts