Soccer Inc. (SI) is a public corporation incorporated in 20X2. SI operates a professional soccer team and

Question:

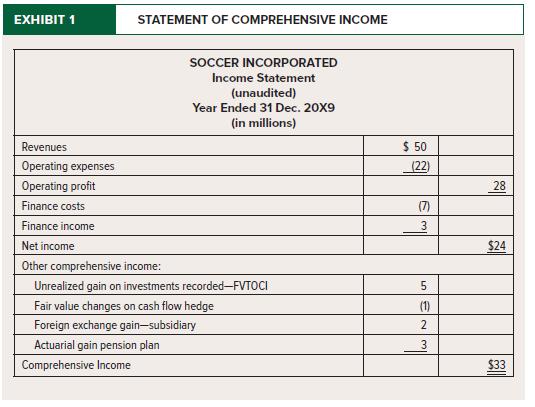

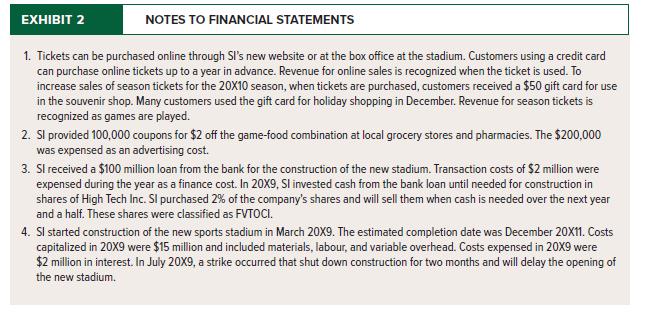

Soccer Inc. (SI) is a public corporation incorporated in 20X2. SI operates a professional soccer team and related activities. New bank financing was obtained in 20X9 for the construction of a new stadium. The bank requires annual audited financial statements and SI has a covenant with a maximum debt-to-equity ratio. SI’s players have an agreement with SI that entitles them to a bonus if SI exceeds net income of $25 million in the year. They agreed to this new bonus arrangement in 20X9 instead of a salary increase. Net income before any adjustments on 31 December 20X9 was $24 million. The players are upset, since the games have been well attended and they anticipated a substantial bonus payment. Management has stated that they have invested in the future, which will provide healthy bonuses in later years. Exhibit 1 includes the income statement.

You have been hired by the players to review the accounting policies for SI’s 31 December year-end. Exhibit 2 provides the notes to the financial statements. You have been asked by the players to analyze the current accounting policies; discuss alternatives, where possible; and provide recommendations on the appropriate accounting policies for events that have occurred during 20X9. The incremental borrowing rate for SI is 10%. The tax rate for SI is 30%.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel