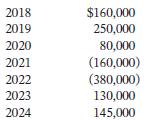

The accounting income (loss) figures for Farah Corporation are as follows: Accounting income (loss) and taxable income

Question:

The accounting income (loss) figures for Farah Corporation are as follows: Accounting income (loss) and taxable income (loss) were the same for all years involved. Assume a 30% tax rate for 2018 and 2019, and a 25% tax rate for the remaining years.

Accounting income (loss) and taxable income (loss) were the same for all years involved. Assume a 30% tax rate for 2018 and 2019, and a 25% tax rate for the remaining years.

InstructionsPrepare the journal entries for each of the years 2020 to 2024 to record income tax expense and the effects of the tax loss carrybacks and carryforwards, assuming Farah uses the carryback provision first. All income and losses relate to normal operations and it is more likely than not that the company will generate substantial taxable income in the future.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119740445

13th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy