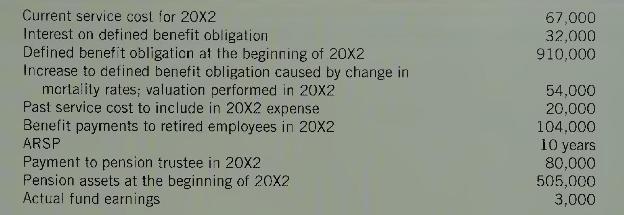

The following information relates to the pension plan of Butler Machinery Corporation, which has a contributory defined

Question:

The following information relates to the pension plan of Butler Machinery Corporation, which has a contributory defined benefit pension plan:

The following cases are independent.

Case \(A\)

Butler includes expected earnings at a rate of \(5 \%\) in the calculation of pension expense. Opening unrecognized actuarial losses were \(\$ 87,000\) and the company uses the \(10 \%\) corridor method based on opening balances.

Case \(B\)

Butler includes expected earnings at a rate of \(5 \%\) in the calculation of pension expense. Opening unrecognized actuarial losses were \(\$ 87,000\) and the company is amortizing the full opening balance of actuarial gains or losses to pension expense over the ARSP, with no reference to a corridor.

Case \(C\)

Butler includes expected earnings at a rate of \(5 \%\) in the calculation of pension expense. Actuarial gains and losses are included in pension expense in the year they arise. There was no opening balance of unrecognized actuarial gains or losses.

Case \(D\)

Butler includes expected earnings at a rate of \(5 \%\) in the calculation of pension expense. Actuarial gains and losses are recorded as an adjustment to reserves and included as an element of other comprehensive income in the year they arise. There was no opening balance of unrecognized actuarial gains or losses.

Required:

For each case

1. Compute \(20 \mathrm{X} 2\) pension expense.

2. Give the \(20 \mathrm{X} 2\) entry(ies) for Butler Company to record pension expense (and other adjustments in Case D) and funding.

3. In which case is the recorded pension asset or liability account likely to be more consistent with the net unfunded position of the plan? Explain; do not calculate.

Step by Step Answer: