The records of Victoria Corp. showed the following balances on 1 November 20X5: On 5 November 20X5,

Question:

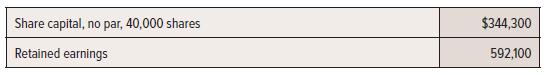

The records of Victoria Corp. showed the following balances on 1 November 20X5:

On 5 November 20X5, the board of directors declared a stock dividend to the shareholders of record as of 20 December 20X5. The dividend was one additional share for each five shares already outstanding; issue date, 10 January 20X6. The appropriate market value of the shares was $12.50 per share. The annual accounting period ends 31 December. The stock dividend was recorded on the declaration date with a memo entry only.

Required:

1. Give entries in parallel columns for the stock dividend on the issue date assuming:

Case A Fair value is capitalized.

Case B $10 per share is capitalized.

Case C Average paid in is capitalized.

2. Explain when each value is most likely to be used.

3. With respect to the stock dividend, what should be reported on the statement of financial position at 31 December 20X5?

4. Explain how the financial statements as of 31 December 20X5 would be different if the stock dividend were recognized on the declaration date.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel