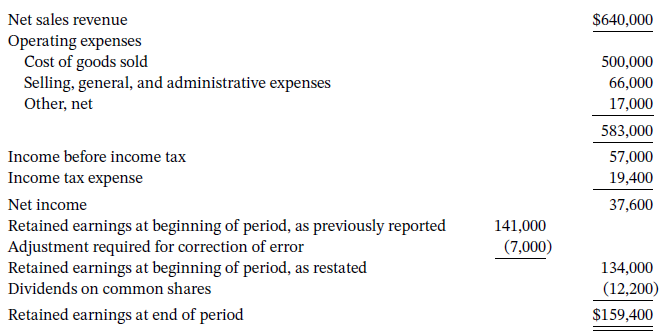

A combined single-step income statement and statement of retained earnings for California Tanning Salon Corp. follows for

Question:

A combined single-step income statement and statement of retained earnings for California Tanning Salon Corp. follows for 2020 (amounts in thousands):

Additional facts are as follows:1. Selling, general, and administrative expenses for 2020 included a usual but infrequently occurring charge of $10.5 million for a loss on inventory due to a decline in net realizable value.

2. ?Other, net? for 2020 included the results of an identified component of the business that management had determined would be eliminated from the future operations of the business ($9 million). If the decision had not been made to discontinue the operation, income tax for 2020 would have been $22.4 million instead of $19.4 million. The component has one asset, a piece of equipment with a carrying value of $3.2 million, which is included on the company?s statement of financial position under property, plant, and equipment (and is equal to the fair value).

3. ?Adjustment required for correction of an error? resulted from a change in estimate as the useful life of certain assets was reduced to eight years and a catch-up adjustment was made.

4. The company disclosed earnings per common share for net income in the notes to the financial statements. The company has elected to adopt ASPE.

Instructionsa. Discuss the appropriate presentation of the facts in the California Tanning Salon Corp. income statement and statement of retained earnings and discuss the theory that supports the presentation.

b. Prepare a revised combined statement of income and retained earnings for California Tanning Salon Corp.

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 978-1119496496

12th Canadian edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy