Question: A company located in Canada spends $6,000 to purchase a foreign currency futures contract to buy US$500,000 at C$1.02:US$1.00. The contract matures 90 days later.

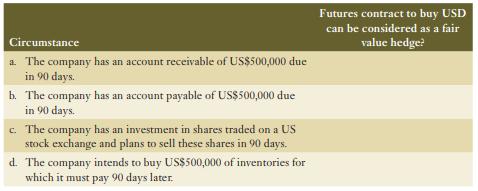

A company located in Canada spends $6,000 to purchase a foreign currency futures contract to buy US$500,000 at C$1.02:US$1.00. The contract matures 90 days later. Under which of the following circumstances could the company consider this future contract to be a fair value hedge for accounting purposes?

Circumstance a. The company has an account receivable of US$500,000 due in 90 days. b. The company has an account payable of US$500,000 due in 90 days. c. The company has an investment in shares traded on a US stock exchange and plans to sell these shares in 90 days. d. The company intends to buy US$500,000 of inventories for which it must pay 90 days later. Futures contract to buy USD can be considered as a fair value hedge?

Step by Step Solution

3.47 Rating (167 Votes )

There are 3 Steps involved in it

a The company has an account receivable of US500000 d... View full answer

Get step-by-step solutions from verified subject matter experts