Question: Actuary and trustee reports indicate the following changes in the PBO and plan assets of Lakeside Cable during 2021: Required: 1. Determine Lakesides pension expense

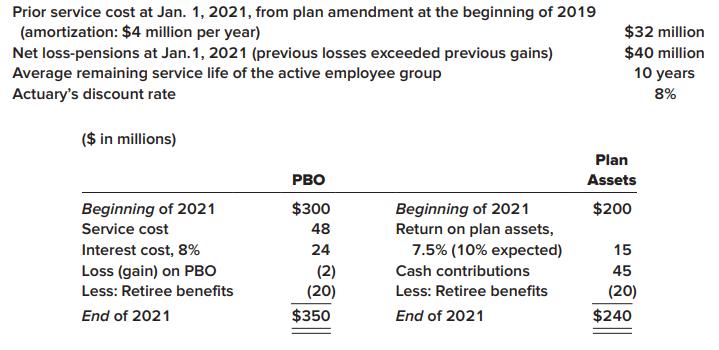

Actuary and trustee reports indicate the following changes in the PBO and plan assets of Lakeside Cable during 2021:

Required:

1. Determine Lakeside’s pension expense for 2021, and prepare the appropriate journal entries to record the expense as well as the cash contribution to plan assets and payment of benefits to retirees.

2. Determine the new gains and/or losses in 2021 and prepare the appropriate journal entry(s) to record them.

3. Prepare a pension spreadsheet to assist you in determining end of 2021 balances in the PBO, plan assets, prior service cost—AOCI, the net loss—AOCI, and the pension liability.

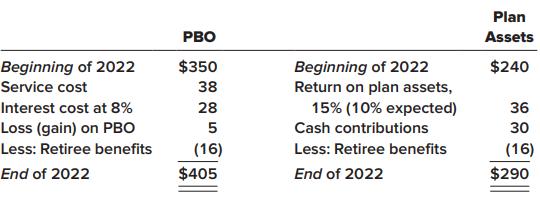

4. Assume the following actuary and trustee reports indicating changes in the PBO and plan assets of Lakeside Cable during 2022 ($ in millions):

Determine Lakeside’s pension expense for 2022, and prepare the appropriate journal entries to record the expense, the cash funding of plan assets, and payment of benefits to retirees.

5. Determine the new gains and/or losses in 2022, and prepare the appropriate journal entry(s) to record them.

6. Using T-accounts, determine the balances at December 31, 2022, in the net loss—AOCI and prior service cost—AOCI.

7. Confirm the balances determined in requirement 6 by preparing a pension spreadsheet.

Prior service cost at Jan. 1, 2021, from plan amendment at the beginning of 2019 (amortization: $4 million per year) Net loss-pensions at Jan. 1, 2021 (previous losses exceeded previous gains) $32 million $40 million 10 years Average remaining service life of the active employee group Actuary's discount rate 8% ($ in millions) Plan PBO Assets Beginning of 2021 Return on plan assets, Beginning of 2021 $300 $200 Service cost 48 Interest cost, 8% 24 7.5% (10% expected) 15 Loss (gain) on PBO 45 (2) (20) Cash contributions Less: Retiree benefits Less: Retiree benefits (20) End of 2021 $350 End of 2021 $240

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Pension Spreadsheet The elements of pension plan are projected benefit obligation plan assets prior service cost gains and losses periodic pension expense and fund status of the plan The projected ben... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

1965_61d6ac341ab3b_828274.pdf

180 KBs PDF File

1965_61d6ac341ab3b_828274.docx

120 KBs Word File