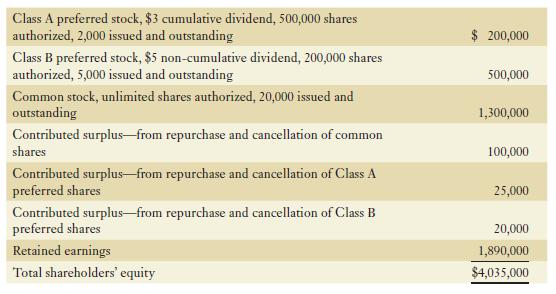

As of January 1, 2021, the equity section of Gail and Samson Inc.s balance sheet contained the

Question:

As of January 1, 2021, the equity section of Gail and Samson Inc.’s balance sheet contained the following:

■ Dividends were last paid in 2018. There were no arrears at that time.

■ On February 1, 2021, Gail sold 1,000 common shares for $65,000 cash.

■ On March 1, 2021, Gail issued a 5% stock dividend on common shares. Gail’s stock traded at $65 per share after the dividend.

■ On April 1, 2021, Gail declared $50,000 in cash dividends, payable on April 15, 2021.

■ On April 15, 2021, Gail paid the dividends declared on April 1.

■ On May 1, 2021, Gail repurchased and cancelled 1,000 Class B preferred shares at $110 per share.

■ On June 1, 2021, Gail spent $75,000 to repurchase 1,000 common shares. These shares were cancelled immediately.

■ On July 1, 2021, Gail declared and distributed a two-for-one stock split on the common shares.

Required:

a. Assume that Gail and Samson Inc. follow the guidance in ASPE pertaining to accounting for equity transactions. Record the journal entries for the above transactions occurring in 2021.

b. Briefly describe the procedure for recording the two-for-one stock split.

c. How much was the dividend per share amount paid to the common shareholder?

Step by Step Answer: