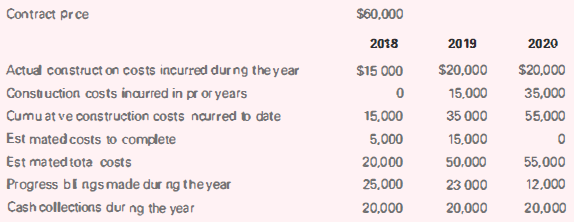

Question: Bernard Brothers Building (BBB) signed a contract for a fixed fee of $60.000 and used the completed-contract method to account for the contract. BBB provided

Bernard Brothers Building (BBB) signed a contract for a fixed fee of $60.000 and used the completed-contract method to account for the contract. BBB provided the following information related to the contract.

Required

a. Prepare the journal entries required for each year of the contract.

b. Prepare the t-accounts for construction in progress, billings on construction in progress, and accounts receivable.

c. Determine the net asset (liability) for each year of the contract on December 31.

Contract prce $60,000 2018 2019 2020 Actual construct on costs incurred dur ng the year Constuction costs inaurred in pr or years Cumu at ve construction costs naurred b date Est mated costs to complete Est mated tota costs Progress b ngsmade dur ng the year Cash collections dur ng the year $20,000 15,000 35 000 15,000 $20,000 $15 000 35,000 15,000 55,000 5,000 20,000 25,000 20,000 55,000 12,000 50.000 23 000 20,000 20,000

Step by Step Solution

3.55 Rating (173 Votes )

There are 3 Steps involved in it

a Journal entries Account 2018 2019 2020 Debit Credit Debit Credit Debit Credit Construction in Prog... View full answer

Get step-by-step solutions from verified subject matter experts