Question: Cisco Systems, Inc., the leading Internet protocol-based networking equipment company, has significant holdings of investment securities. Use the financial statement information provided to analyze Ciscos

Cisco Systems, Inc., the leading Internet protocol-based networking equipment company, has significant holdings of investment securities. Use the financial statement information provided to analyze Cisco’s holdings and answer the following questions and complete the following requirements:

1. What types of investments are in the firm’s portfolio in fiscal 2019 and 2018? What percentage of total assets do its investments compose? Comment on changes in the composition and percentage of investments to total assets from year to year. Use fair value.

2. Which investment securities did Cisco report at fair value in fiscal 2019 and 2018? What is the difference between fair value and cost?

3. Determine the effect of changes in fair value on net income and other comprehensive income in fiscal 2019, 2018, and 2017. If unrealized gains and losses on available-for-sale securities were reported in net income rather than other comprehensive income, what would be the effect on net income in fiscal 2019, 2018, and 2017?

4. For its investment securities, determine the types and amount of investments in each level in the hierarchy in fiscal 2019.

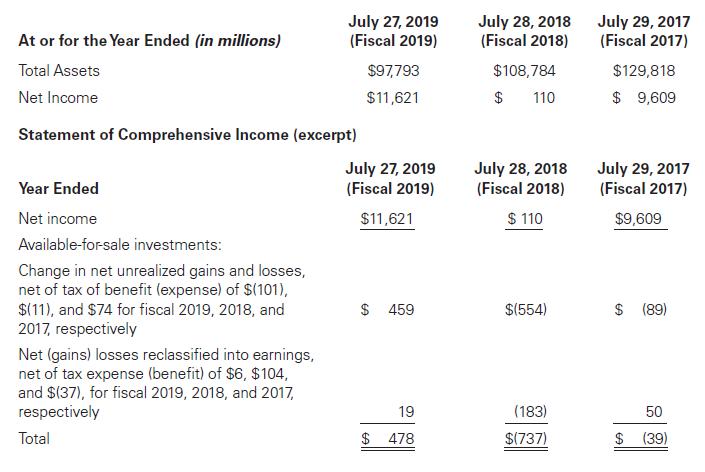

At or for the Year Ended (in millions) Total Assets Net Income Statement of Comprehensive Income (excerpt) Year Ended Net income Available-for-sale investments: Change in net unrealized gains and losses, net of tax of benefit (expense) of $(101), $(11), and $74 for fiscal 2019, 2018, and 2017, respectively July 27, 2019 (Fiscal 2019) Net (gains) losses reclassified into earnings, net of tax expense (benefit) of $6, $104, and $(37), for fiscal 2019, 2018, and 2017, respectively Total $97,793 $11,621 July 27, 2019 (Fiscal 2019) $11,621 $ 459 19 $ 478 July 28, 2018 (Fiscal 2018) $108,784 $ 110 July 28, 2018 (Fiscal 2018) $ 110 $(554) (183) $(737) July 29, 2017 (Fiscal 2017) $129,818 $9,609 July 29, 2017 (Fiscal 2017) $9,609 $ (89) $ 50 (39)

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

1 From Note 9 a Cisco holds 21660 million and 37009 million of debt securities classified as availableforsale at the end of fiscal 2019and 2018 respec... View full answer

Get step-by-step solutions from verified subject matter experts