Question: Coastal Forests International began operations in 2016. Selected information relating to the companys operations is shown in the following table (DIT denotes deferred income tax.

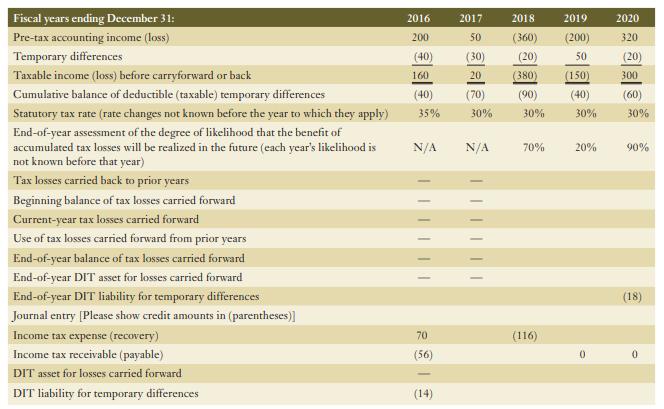

Coastal Forests International began operations in 2016. Selected information relating to the company’s operations is shown in the following table (DIT denotes deferred income tax. Amounts other than percentages are in $000’s):

Required:

Complete the missing information in the table.

Fiscal years ending December 31: Pre-tax accounting income (loss) Temporary differences Taxable income (loss) before carryforward or back Cumulative balance of deductible (taxable) temporary differences Statutory tax rate (rate changes not known before the year to which they apply) End-of-year assessment of the degree of likelihood that the benefit of accumulated tax losses will be realized in the future (each year's likelihood is not known before that year) Tax losses carried back to prior years Beginning balance of tax losses carried forward Current-year tax losses carried forward Use of tax losses carried forward from prior years End-of-year balance of tax losses carried forward End-of-year DIT asset for losses carried forward End-of-year DIT liability for temporary differences Journal entry [Please show credit amounts in (parentheses)] Income tax expense (recovery) Income tax receivable (payable) DIT asset for losses carried forward DIT liability for temporary differences 2016 200 (40) 160 (40) (70) 35% N/A 111111 70 (56) 2017 2018 50 (360) (200) (30) (20) 50 20 (380) (150) (90) (40) 30% 30% 30% N/A 70% 2019 2020 320 (116) 20% (20) 300 (60) 30% 90% (18)

Step by Step Solution

3.41 Rating (167 Votes )

There are 3 Steps involved in it

ANSWER Fiscal years ending December 31 2016 2017 2018 2019 2020 Pretax accounting income loss 200 50 ... View full answer

Get step-by-step solutions from verified subject matter experts