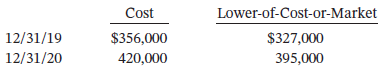

Corrs Company began operations in 2019 and determined its ending inventory at cost and at lower-of-LIFO cost-or-market

Question:

Corrs Company began operations in 2019 and determined its ending inventory at cost and at lower-of-LIFO cost-or-market at December 31, 2019, and December 31, 2020. This information is presented below.

Instructions

a. Prepare the journal entries required at December 31, 2019, and December 31, 2020, assuming that the inventory is recorded at market, and a perpetual inventory system (cost-of-goods-sold method) is used.

b. Prepare journal entries required at December 31, 2019, and December 31, 2020, assuming that the inventory is recorded at market under a perpetual system (loss method is used).

c. Which of the two methods above provides the higher net income in each year?

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1119503668

17th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfiel