Question: Data for Brecker Inc. are presented in E23.13. Brecker Inc., a greeting card company, had the following statements prepared as of December 31, 2020. Instructions

Data for Brecker Inc. are presented in E23.13.

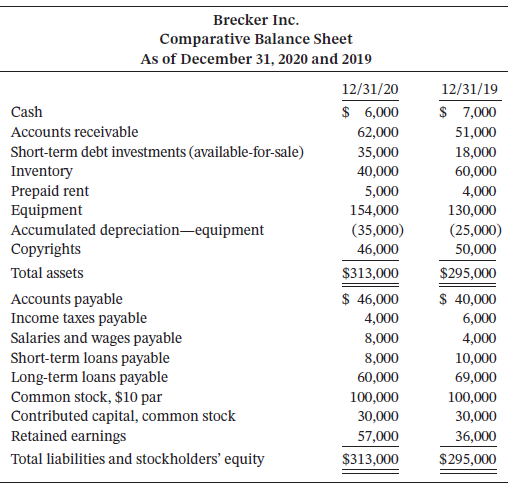

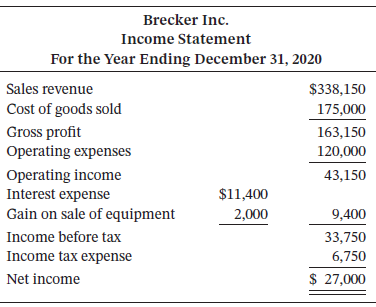

Brecker Inc., a greeting card company, had the following statements prepared as of December 31, 2020.

Instructions

Prepare a statement of cash flows using the indirect method.

Brecker Inc. Comparative Balance Sheet As of December 31, 2020 and 2019 12/31/20 12/31/19 $ 6,000 $ 7,000 Cash Accounts receivable 62,000 51,000 Short-term debt investments (available-for-sale) 35,000 18,000 Inventory 40,000 60,000 Prepaid rent Equipment Accumulated depreciation-equipment Copyrights 5,000 4,000 130,000 154,000 (35,000) (25,000) 46,000 50,000 Total assets $313,000 $295,000 Accounts payable Income taxes payable Salaries and wages payable Short-term loans payable Long-term loans payable Common stock, $10 par Contributed capital, common stock Retained earnings $ 46,000 $ 40,000 4,000 6,000 8,000 4,000 8,000 10,000 60,000 69,000 100,000 100,000 30,000 30,000 57,000 $313,000 36,000 Total liabilities and stockholders' equity $295,000 Brecker Inc. Income Statement For the Year Ending December 31, 2020 Sales revenue $338,150 Cost of goods sold 175,000 Gross profit Operating expenses 163,150 120,000 Operating income Interest expense 43,150 $11,400 Gain on sale of equipment 2,000 9,400 Income before tax 33,750 Income tax expense 6,750 Net income $ 27,000

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Supplemental disclosures of cash flow information Cash paid during the year for Interest 1140... View full answer

Get step-by-step solutions from verified subject matter experts