Question: Dingel Corporation has contracted with you to prepare a statement of cash flows. The controller has provided the following information. Additional data related to 2020

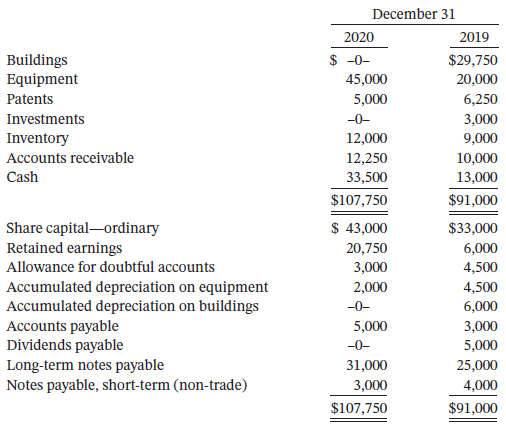

Dingel Corporation has contracted with you to prepare a statement of cash flows. The controller has provided the following information.

Additional data related to 2020 are as follows.

1. Equipment that had cost $11,000 and was 40% depreciated at time of disposal was sold for $2,500.

2. $10,000 of the long-term notes payable was paid by issuing ordinary shares.

3. Cash dividends paid were $5,000.

4. On January 1, 2020, the building was completely destroyed by a flood. Insurance proceeds on the building were $32,000.

5. Equity investments (non-trading) were sold at $1,700 above their cost.

6. Cash was paid for the acquisition of equipment.

7. A long-term note for $16,000 was issued for the acquisition of equipment.

8. Interest of $2,000 and income taxes of $6,500 were paid in cash.

Instructions

Prepare a statement of cash flows using the indirect method.

December 31 2020 2019 $ -0- Buildings Equipment $29,750 45,000 20,000 Patents 5,000 6,250 Investments -0- 3,000 Inventory 12,000 9,000 Accounts receivable 12,250 10,000 Cash 33,500 13,000 $107,750 $91,000 $ 43,000 Share capital-ordinary Retained earnings $33,000 20,750 6,000 Allowance for doubtful accounts 3,000 4,500 Accumulated depreciation on equipment Accumulated depreciation on buildings Accounts payable Dividends payable Long-term notes payable Notes payable, short-term (non-trade) 2,000 4,500 -0- 6,000 5,000 3,000 5,000 -0- 31,000 25,000 3,000 4,000 $107,750 $91,000

Step by Step Solution

3.48 Rating (168 Votes )

There are 3 Steps involved in it

Supplemental disclosures of cash flow information Cash paid during the year for Interest 2000 Income taxes 6500 Noncash investing and financing activi... View full answer

Get step-by-step solutions from verified subject matter experts