Question: During 2020, Darwin Corporation started a construction job with a contract price of $4.2 million. Darwin ran into severe technical difficulties during construction but managed

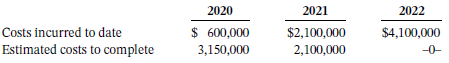

During 2020, Darwin Corporation started a construction job with a contract price of $4.2 million. Darwin ran into severe technical difficulties during construction but managed to complete the job in 2022. The contract is non-cancellable. Under the terms of the contract, Darwin sends billings as revenues are earned. Billings are non refundable. The following information is available:

a. Calculate the amount of gross profit that should be recognized each year under the percentageof- completion method.

b. Prepare the year-end journal entries for 2021 to record revenues and expenses from the contract, assuming the percentage-of-completion method is used. Explain the treatment of the reduction in overall gross profit under the percentage-of-completion method.

c. Calculate the amount of gross profit or loss that should be recognized each year under the completed contract method. Explain the treatment of losses under the completed-contract method.

2022 2020 2021 Costs incurred to date Estimated costs to complete $2,100,000 $4,100,000 3,150,000 -0-

Step by Step Solution

3.31 Rating (157 Votes )

There are 3 Steps involved in it

a Gross profit recognized in PercentageofCompletion 000 omitted 2020 2021 2022 Contract price 4200 4... View full answer

Get step-by-step solutions from verified subject matter experts