Exclusive Golf Vacations sells bonds to friends and families to finance the acquisition of a small tropical

Question:

Exclusive Golf Vacations sells bonds to friends and families to finance the acquisition of a small tropical island on which it intends to build a golf resort. On January 1, 2018, the company sells $10,000,000 of 5% bonds at 103. The three-year bonds mature on January 1, 2021, with interest payable on June 30 and December 31 each year.

Exclusive Golf Vacations’ year-end is December 31. As it is a private corporation and the bonds are not publicly traded, Exclusive has elected to report its financial results in accordance with Part II of the CPA Canada Handbook— Accounting (ASPE) and uses the straight-line method of amortization.

Required:

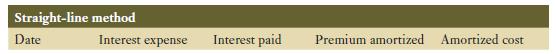

a. Complete a bond amortization spreadsheet using the format that follows:

b. Prepare the journal entry to record the issuance of the bonds.

c. Prepare the journal entry to record the payment of interest and related amortization on June 30, 2018.

d. Prepare the journal entry to record the derecognition of the bonds at maturity.

Step by Step Answer: