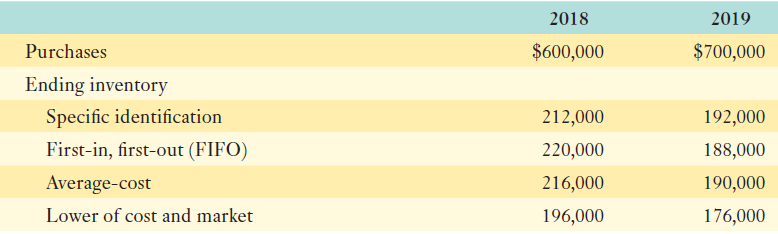

Ferro Ltd. began operations on January 1, 2018. Merchandise purchases and four alternative methods of valuing inventory

Question:

Required:

a. Which of the four methods listed above does not apply matching? Briefly explain.

b. Determine the cost flow assumption or inventory valuation method that would report the highest net income for 2018.

c. Assuming that FIFO had been used for both years, how much would be the cost of goods sold for 2019?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: