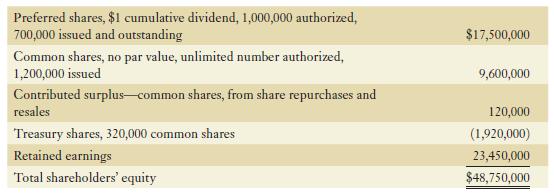

Hamilton Holdings had the following balances in shareholders equity as at December 31, 2021: In addition, the

Question:

Hamilton Holdings had the following balances in shareholders’ equity as at December 31, 2021:

In addition, the financial statement notes on this date indicated that two years of preferred share dividends were in arrears, totalling $1,400,000.

The following transactions occurred during 2022:

i. January 31: Hamilton resold half of the shares held in treasury for proceeds of $7.50 each.

ii. March 30: The company repurchased and immediately cancelled 200,000 common shares at a cost of $1,620,000.

iii. June 1: The company repurchased and retired 175,000 preferred shares at a price of $30 each. Note that repurchased shares lose any rights to dividends.

iv. July 13: The company issued 250,000 common shares in exchange for some heavy machinery. The market price of the shares was $9 on this day.

v. August 1: The remaining shares held in treasury were cancelled. The share price was $9.50.

vi. September 30: The board of directors declared and issued a 10% stock dividend on common shares. The shares were trading at $11 per share on this day. On the ex-dividend date of October 31, the share price was $10. To issue this stock dividend, the board also declared dividends on preferred shares for the current year and the two years in arrears.

Required:

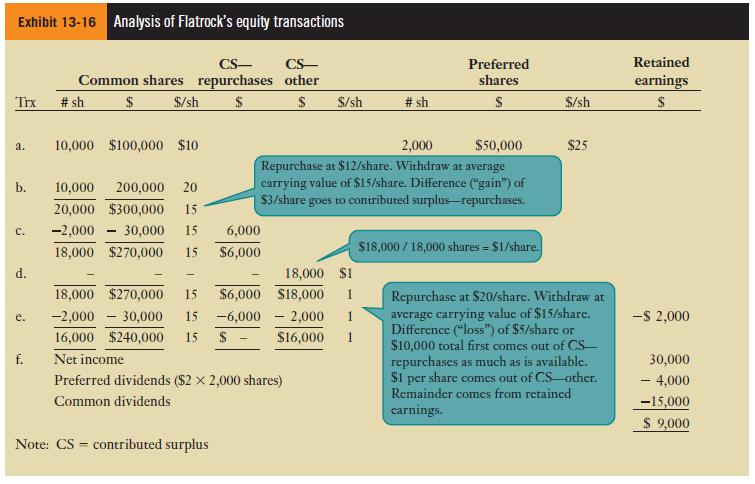

Assume that Hamilton follows the guidance in ASPE pertaining to accounting for equity transactions. Prepare the journal entries to reflect Hamilton’s equity transactions in 2022. It may be helpful to use a tabular schedule similar to Exhibit 13-16 to track the number of shares and dollar amounts.

Exhibit 13-16

Step by Step Answer: