Holtzman Company is in the process of preparing its financial statements for 2020. Assume that no entries

Question:

Holtzman Company is in the process of preparing its financial statements for 2020. Assume that no entries for depreciation have been recorded in 2020. The following information related to depreciation of fixed assets is provided to you.

1. Holtzman purchased equipment on January 2, 2017, for $85,000. At that time, the equipment had an estimated useful life of 10 years with a $5,000 salvage value. The equipment is depreciated on a straight-line basis. On January 2, 2020, as a result of additional information, the company determined that the equipment has a remaining useful life of 4 years with a $3,000 salvage value.

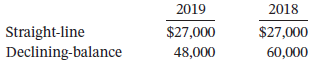

2. During 2020, Holtzman changed from the double-declining-balance method for its building to the straight-line method. The building originally cost $300,000. It had a useful life of 10 years and a salvage value of $30,000. The following computations present depreciation on both bases for 2018 and 2019.

3. Holtzman purchased a machine on July 1, 2018, at a cost of $120,000. The machine has a salvage value of $16,000 and a useful life of 8 years. Holtzman?s bookkeeper recorded straight-line depreciation in 2018 and 2019 but failed to consider the salvage value.

Instructions

a. Prepare the journal entries to record depreciation expense for 2020 and correct any errors made to date related to the information provided. (Ignore taxes.)

b. Show comparative net income for 2019 and 2020. Income before depreciation expense was $300,000 in 2020, and was $310,000 in 2019. (Ignore taxes.)

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Salvage Value

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1119503668

17th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfiel