Question: How would your answer to BE17-20 change if Year 1 income were equal to $100,000? Data from BE17-20 W. Pickett Fence Company incurred a net

How would your answer to BE17-20 change if Year 1 income were equal to $100,000?

Data from BE17-20

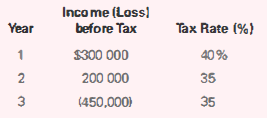

W. Pickett Fence Company incurred a net loss for Year 3. The firm does not have any book-tax differences. We preset the results of operations for the first 3 years of the company"s operations:

Future tax rates are expected to be 35%. W. Pickett always elects the carryback / carryforward option, There are no uncertainties regarding realization of future tax benefits.

Income (Loss! Year before Tax Tax Rate (%) $300 000 40% 200 000 35 35 (450,000)

Step by Step Solution

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Carryback Year NOL Carryback Amount Tax rate NOL Carrybac... View full answer

Get step-by-step solutions from verified subject matter experts