Question: LGD Consulting is a medium-sized provider of environmental engineering services. The corporation sponsors a noncontributory, defined benefit pension plan. Alan Barlow, a new employee and

LGD Consulting is a medium-sized provider of environmental engineering services. The corporation sponsors a noncontributory, defined benefit pension plan. Alan Barlow, a new employee and participant in the pension plan, obtained a copy of the 2021 financial statements, partly to obtain additional information about his new employer’s obligation under the plan. In part, the pension disclosure note reads as follows:

n attempting to reconcile amounts reported in the disclosure note with amounts reported in the income statement and balance sheet, Barlow became confused. He was able to find the pension expense on the income statement but was unable to make sense of the balance sheet amounts. Expressing his frustration to his wife, Barlow said, “It appears to me that the company has calculated pension expense as if they have the pension liability and pension assets they include in the note, but I can’t seem to find those amounts in the balance sheet. In fact, there are several amounts here I can’t seem to account for. They also say they’ve made some assumptions about interest rates, pay increases, and profits on invested assets.

I wonder what difference it would make if they assumed other numbers.” Barlow’s wife took accounting courses in college and remembers most of what she learned about pension accounting. She attempts to clear up her husband’s confusion.

Required:

Assume the role of Barlow’s wife. Answer the following questions for your husband.

1. Is Barlow’s observation correct that the company has calculated pension expense on the basis of amounts not reported in the balance sheet?

2. What amount would the company report as a pension liability in the balance sheet?

3. What amount would the company report as a pension asset in the balance sheet?

4. Which of the other two amounts reported in the disclosure note would the company report in the balance sheet?

5. The disclosure note reports a net actuarial gain as well as an actuarial loss. Does the loss in 2021 indicate that the PBO is higher or is lower than previously expected due to some unspecified change in an actuarial assumption. How are these related? What do the amounts mean?

6. Losses and gains are reported in the statement of comprehensive income as they occur. These amounts accumulate as a net gain or net loss in the balance sheet as part of what account?

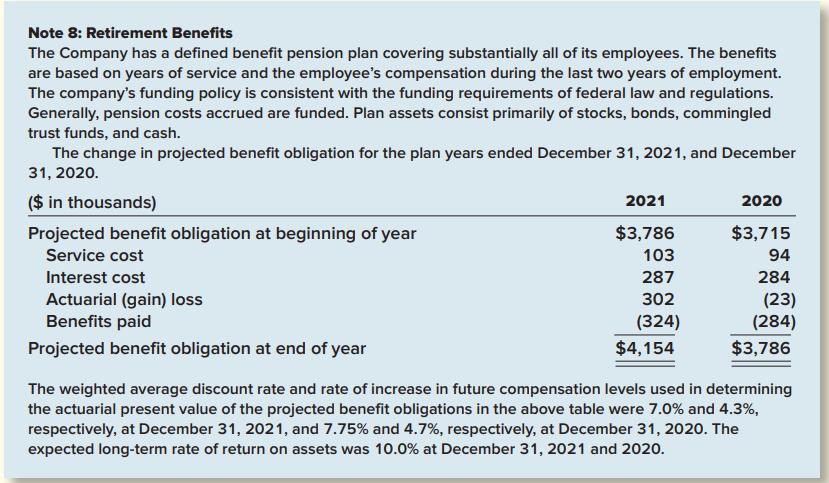

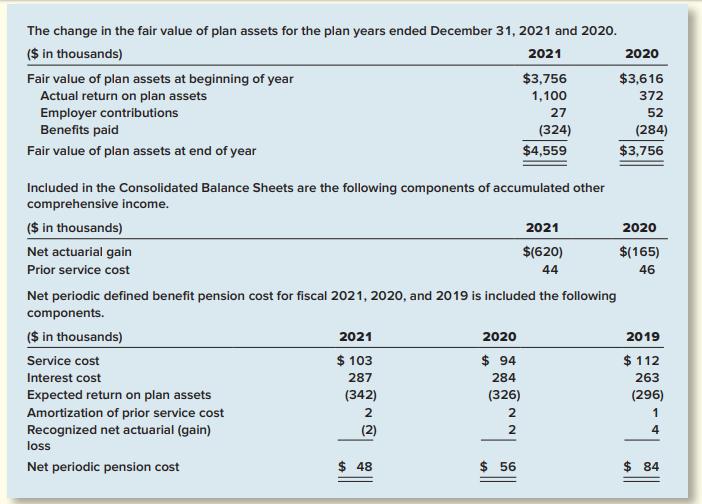

Note 8: Retirement Benefits The Company has a defined benefit pension plan covering substantially all of its employees. The benefits are based on years of service and the employee's compensation during the last two years of employment. The company's funding policy is consistent with the funding requirements of federal law and regulations. Generally, pension costs accrued are funded. Plan assets consist primarily of stocks, bonds, commingled trust funds, and cash. The change in projected benefit obligation for the plan years ended December 31, 2021, and December 31, 2020. ($ in thousands) 2021 2020 Projected benefit obligation at beginning of year $3,786 $3,715 Service cost 103 94 Interest cost 287 284 Actuarial (gain) loss Benefits paid 302 (23) (284) (324) Projected benefit obligation at end of year $4,154 $3,786 The weighted average discount rate and rate of increase in future compensation levels used in determining the actuarial present value of the projected benefit obligations in the above table were 7.0% and 4.3%, respectively, at December 31, 2021, and 7.75% and 4.7%, respectively, at December 31, 2020. The expected long-term rate of return on assets was 10.0% at December 31, 2021 and 2020.

Step by Step Solution

3.48 Rating (184 Votes )

There are 3 Steps involved in it

Projected Benefit Obligation PBO PBO is a pension obligation in accounting The PBO is the discounted present value of total retirement benefit earned ... View full answer

Get step-by-step solutions from verified subject matter experts